Everyone knows they should save at least a portion of their earnings, but how much do you really need to have in the bank vs. in your pocket, so to speak? We’re taking a look and giving you vital information when it comes to saving.

Status of Americans’ savings

In early 2020, Bankrat – a personal finance website – reported results from its Financial Security Index. It found that 41percent of U.S. adults would use savings for the cost of a $1,000 car repair or medical emergency. For those without enough savings to cover this expense, Bankrate found most would default to using a credit card.

Here are other key findings from Bankrate’s report:

- Bankrate reports indicate that the percentage of U.S. adults who would use their savings to cover a $1,000 emergency room visit or car repair has remained within the range of 37 to 41 percent since 2014.

- Nearly four in 10 Americans (37 percent) would borrow money in some capacity if hit with an unexpected bill.

- Among respondents who reported that they or a close relative paid for a major unanticipated expense in the past year (28 percent), the average cost was $3,518.

GoBankingRates, another personal finance website, also survey’s Americans semi-regularly to gain an understanding of saving habits. It has found similar statistics to Bankrate in the last few years. In 2019, it reported 69 percent of respondents have less than $1,000 in their savings account, which was up from 58 percent in 2018.

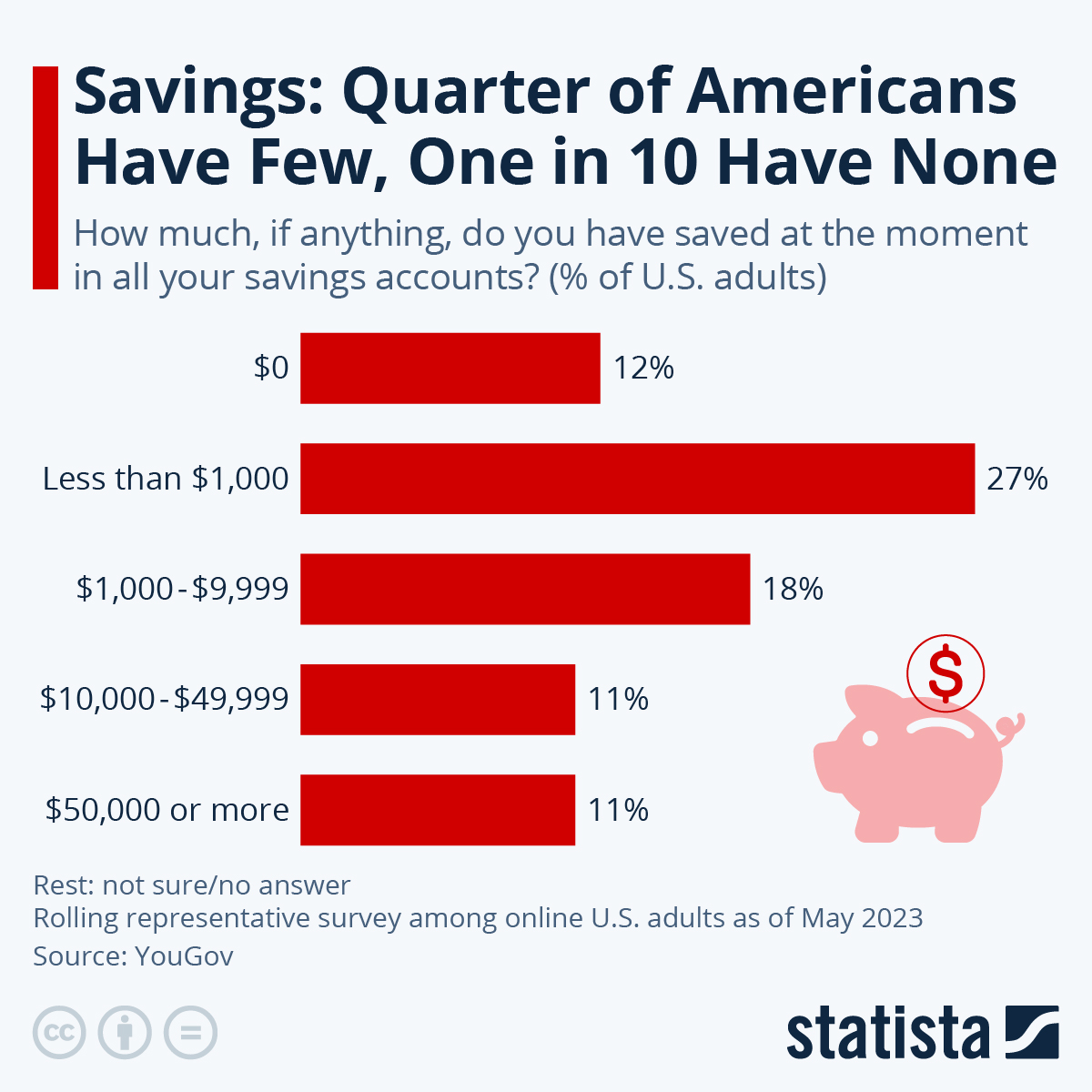

You will find more infographics at Statista

You will find more infographics at Statista

Research from Pew Charitable Trusts in 2015 found 41 percent of Americans who responded to a 7,845-participant survey did not have enough liquid assets for an emergency, $2,000 expense. The survey also revealed that 33 percent of Americans do not have money they consider “savings”— 10 percent of whom make more than $100,000 a year. Most Americans (75 percent) would prefer to use liquid assets (money in savings or checking) for unexpected expenses, according to the survey, but 69 percent of the survey’s total respondents reported they would use multiple sources for covering such an expense. According to Pew, 49 percent would use credit and 36 percent would borrow money. “The typical household would need to increase its liquid savings by over $9,000 to achieve its ideal savings level,” Pew reported.

Now, there are a variety of opinions for how much one should have in savings.

Dave Ramsey, a radio show host and businessman well-known for his personal finance advice, says start with $1,000 for emergencies, putting all other savings efforts toward eliminating debt, except one’s mortgage, before expanding one’s emergency savings account. After debt is gone, he said one should work toward saving between six to eight month’s of expenses.

Ally.com, a financial well-being website, suggests having three to six months’ worth of expenses for emergencies. Ally then lays out about how much that would be at different age groups. For example, at age 30, someone would ideally have between $14,115–$28,230 saved, at 40 between $17,799–$35,599 saved, and at 50 between $18,846–$37,693. From 60 onward, the ideal savings balance is reduced, likely to reduction in expenditures and kicking in of retirement savings. Ally also offers an online savings calculator for those interested in getting a more specific number based on their situation.

Bankrate offers similar emergency savings goals by age, albeit with slightly lower benchmarks.

Getting started and enhancing saving efforts

In a New York Times opinion piece, Alissa Quart, executive director of the Economic Hardship Reporting Project, and Yaryna Serkez, New York Times Opinion section graphics editor, take a look at how much Americans need to get through a pandemic, though the same principles apply for savings at any time. They first state, graphically, that for a family with an annual income of $200,000 or more, it would take two months to save one month’s worth of expenses. If your household income is between $70,000–$99,999, it could take seven to eight months to save for just one month’s worth of expenses. And if your total household income fell between $50,000–$69,999, it could take up to two years to save just that one month.

Once you have a number in mind and you’ve taken care of your debt, as Ramsey and others suggest, selecting the right savings account is the next step. GoBankingRates lists what it considers the “Best Savings Accounts of 2020,” selecting them based on having a low minimum deposit to open the account, having a low minimum balance in the account to avoid fees, and based on its annual percentage yield.

From there, it’s simply a matter of putting aside some of what you earn into that account, rather than spending it or putting it into a checking account. This is perhaps easier said than done. Ramsey offers several tips to reduce spending and to send that money into savings. One is to cut back on your grocery budget. Ordering groceries online and opting for pickup, which is often offered free at larger stores, can prevent you from impulse buying, Ramsey’s website states. Other tips include buying generic products, cancelling automatic subscriptions you don’t need, borrowing tools or items rather than buying them, among other tips. He also suggests sending money directly into savings and learning to live without it from your paycheck all together.

America Saves, a campaign by the Consumer Federation of America, among several general tips for savings suggests starting small. Short term goals, the campaign posits, seem more achievable and can result in positive habit building. The organization also puts forth the perhaps unpopular suggestion of saving your tax refunds or bonuses from work, inheritances, or financial winnings, if you received one, rather than spending it.

In closing, there isn’t one solid number, because it depends on your income and circumstances. But if 2020 taught us anything, it’s this: You better have something put away in savings, because you never know what’s going to happen.