Earlier in the week, I made a passing reference to President Biden’s veto of a Republican effort to stop a Department of Labor rule dealing with retirement funds. Yawn; exciting stuff. The rant wasn’t even about that topic; it was a screed against navel-gazing while the totalitarians have their wedding day. But I feel like this arcane topic deserves a full post.

I wrote of the “Labor Department’s impending rule to allow huge government pension funds like CALPERS to invest not based on their fiduciary duty to their participants (i.e. to maximize the value of the fund) but on environmental, social, and governance scores (ESG) that supposedly benefit “society” (but mostly friends of Democrats).”

As with everything, there’s nuance and background to this story, so let me provide a bit of both. Large retirement funds like CALPERS (California Public Employees’ Retirement System) and the New York City employees’ fund for years have used social measures for their investment policies. Nobody was stopping them, but in the closing days of the Trump administration, the Department of Labor attempted to greatly curtail the ability of fund managers and fiduciaries in that regard. The Biden administration reversed all that, and tried to take it even further by encouraging Environmental, Social and Governance (“ESG”) factors in investment decisions.

The Department of Labor has finalized a rule in effect February 1, 2023, with some provisions delayed until December 1, that changes the legal definition of fiduciary duty according to ERISA (29 CFR § 2550.404a-1). The rule changes “Investment Duties” to recognize the consideration of ESG elements in investment decisions.

This was literally one of the first things the Biden administration sought to deal with upon his taking office in 2021. Under the Trump administration in 2020, the DOL had published two rule changes that tightened “Investment Duties” to consider only “pecuniary factors,” limiting managers to considering only how much financial gain or risk is likely in crafting and executing investment policy.

The second rule, published on December 16, 2020, by the lame-duck Trump DOL, severely limited how fiduciaries (mostly large funds) could exercise their voting proxies for investments the plan has in specific companies dealing with shareholder rights. In other words, the DOL wanted to limit corporate activism by large shareholders purportedly acting in the interests of their fund’s participants.

In early 2021, the Biden DOL noted it would not enforce the Trump rules. So basically, large retirement fund investors like Boeing, IBM, and Wells Fargo, along with public service defined benefit plans like CALPERS, CALSTRS (California Teachers fund), New York state and city’s large funds, along with the Florida State Board of Administration’s nearly 200 billion and Texas’ Teacher Retirement System with about the same, could consider ESG factors and use their significant holdings in various companies because the DOL wasn’t going to enforce the Trump-era rules.

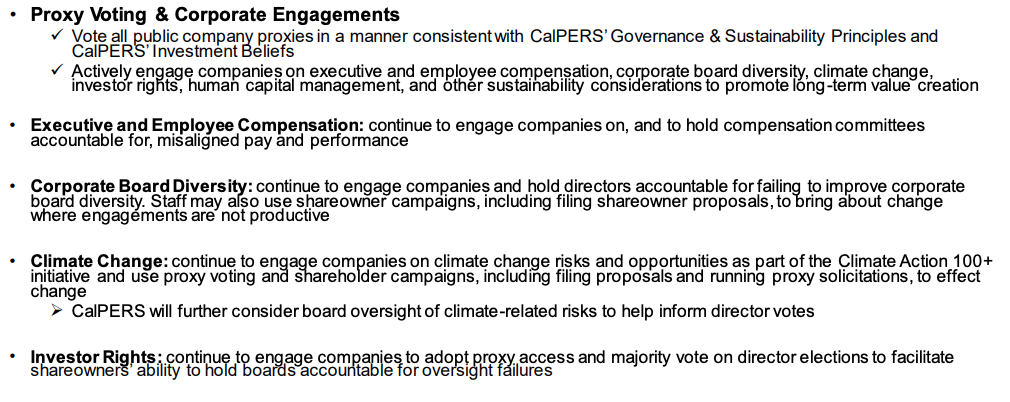

The Trump rules emanated as a reaction to events like shareholder proposals in 2016 and 2017, joined by CALPERS and other large institutional investors, demanding ExxonMobile increase its commitment and assessment of risks associated with climate change as part of its business model. CALPERS held 9.5 million shares of ExxonMobil at the time of the filing. The proposal was adopted, and the company appointed a climate expert to its board.

In 2018, CALPERS and the other large investors pushed for ExxonMobil to reduce greenhouse gas emissions for all its operations, making that part of the company’s business plan. That proposal failed to pass.

As part of its investment and governance policy, CALPERS views proxy voting guidelines founded on sustainabilityprinciples, as do many funds. The Trump efforts would have made many of these practices subject to the heavy hand of regulation, if they had been enforced (which, they weren’t).

It makes perfect sense that the Biden administration would reverse the Trump measures, but they didn’t just do that. They attempted to bake ESG into fiduciary duty for fund managers. The final draft of the DOL rule didn’t go as far as the original, but it does more than simply repeal the Trump changes, which essentially forbid funds from considering ESG unless those efforts generated a “pecuniary” advantage.

From the DOL’s point of view, fiduciary duty is whatever the law and regulations says it is, so by following the law, a fund can’t abridge that duty by considering ESG (although there was some real angst about the late 2020 Trump rules, until the Biden DOL said they weren’t going to enforce them.

But is the DOL’s version of fiduciary duty the only definition that matters?

The question arises from this: what is a fiduciary duty? Investopedia offers this (the parts that are relevant to the discussion at hand):

- A fiduciary duty involves actions taken in the best interests of another person or entity.

- Fiduciary duties include duty of care, loyalty, good faith, confidentiality, prudence, and disclosure.

- A breach of fiduciary duty occurs when a fiduciary fails to act responsibly in the best interests of a client.

I believe that when the government puts its thumb on the scale of large funds, which have significant sway over giant public companies, this creates a distorted view of fiduciary duty, which in fact isn’t always in the best interests of the fund participants.

By encouraging the funds to do more corporate activism based on political winds, the DOL is engaging in a form of corporatism disguised as investment policy. Instead of the government mandating large corporations having to deal with carbon credits (which are fungible representations of other companies’ “carbon footprint,” allowing them to buy their way into greenness), the funds do this work. They do it on their own behalf, using the assets of their participants as their leverage.

The 2022 proxy goals of CALPERS (I apologize for making this a CALPERS piece, as there are many fund doing this, but I thought I’d stick with one example) included:

I believe investors should be free to consider their own values, and that the government should act as the enforcer of benefit fund managers and plan sponsors to act in the best financial interests of participants, not their social interests or as planetary savior. In the case of the Biden DOL proposal, companies are being encouraged to emulate CALPERS, and therefore I was in favor of the Republican-led (it took a couple of Democrats to get it through the Senate) bill to overturn the DOL ruling.

In the U.S., ERISA (the law that governs benefits management) pierces the corporate veil for fiduciaries. That means fiduciaries are personally liable if they breach their duty to participants, and can be personally sued into ruin. The DOL regulates what is and isn’t kosher for fiduciaries, and with the new DOL regulations, it is not possible for participants to sue a fund fiduciary for following corporate activist policies at the expense of solid financial analysis. Yes, you can have both, but where is the balance? The manager can say they were following the ESG bandwagon, and of course, not all fund managers have the same resources or skill.

When deals are structured by investment bankers, they know they’ll have the cover of ESG for the large funds to back a venture. So what’s a few basis points (hundredths of a percentage) in a $50 billion deal, or the commission on an IPO or SPAC acquisition, between fellow travelers in the climate change universe, or the Democratic Party? If the deal doesn’t work out, they can just claim they were following ESG guidance, because it’s good for the planet (even if it wasn’t so good for the workers whose money the invested).

I wasn’t a huge fan of the Trump DOL rules, because I think there’s more than just “pecuniary” factors in investment decisions. On paper, Theranos, FTX, and even Bernie Madoff had some attractive numbers, but you know what they say about “too good to be true.” There’s plenty of “too good to be true” opportunities out there, and in the green tech space, there’s billions to be made (and some to be had, in the grifter sense of the word). You have to be able to believe in the managers and the enterprise, which isn’t always a “pecuniary” decision.

But the government should not be in the business of saying which opportunities are protected by an ESG umbrella, and which ones are to be shunned. If CALPERS does that on its own, its managers should be subject to the same threat of lawsuits as any other fiduciary not living up to the obligation. The Biden DOL rules give these funds an umbrella they didn’t have before, even if Trump tried to make the government act in the place of participants (too far the other way).

ESG isn’t all it’s cracked up to be, when it’s used to shield corporatism and activism on behalf of employees who didn’t ask for either.

Follow Steve on Twitter @stevengberman.

The First TV contributor network is a place for vibrant thought and ideas. Opinions expressed here do not necessarily reflect those of The First or The First TV. We want to foster dialogue, create conversation, and debate ideas. See something you like or don’t like? Reach out to the author or to us at ideas@thefirsttv.com.